If you have excellent credit theres a good chance that a friend or family member has asked you to co-sign a car loan at some point. Maybe you lost your job and are having trouble making payments or the car just doesnt fit your needs anymore.

Can I Refinance My Car Loan To Someone Else Auto Credit Express

This can be the primary driver of the car or someone else if the car is meant as a surprise gift.

. Here are a few costs you might have to consider when transferring a car title. Co-signing an auto loan is one of the most misunderstood topics in the car-buying process. Consider buying a car for cash.

However you wont be able to get it home or to its primary driver. This problem is easily avoidable by bringing along a licensed driver to the lot. Ask someone you trust and who trusts you who has good credit to cosign the bad credit auto loan for you.

The new loan can be for the remaining duration of the old one or even shorter though in most cases the more popular choice is to extend the length of time youll need to pay off the loan. When you find the specific vehicle youre interested in complete the interest form on that vehicles detail page with. Although home equity lines of credit HELOCs and home equity loans require a FICO Score of at least 660 to 700 a lender might approve a cash-out loan for someone with a lower score.

Your credit score and credit history. And canceling a car insurance policy when the policyholder passes away may be. Thankfully early termination isnt your only option.

Consolidation is common with student loans. Your state may require a flat transfer fee to transfer your car title to someone else. A lender also will examine your credit history.

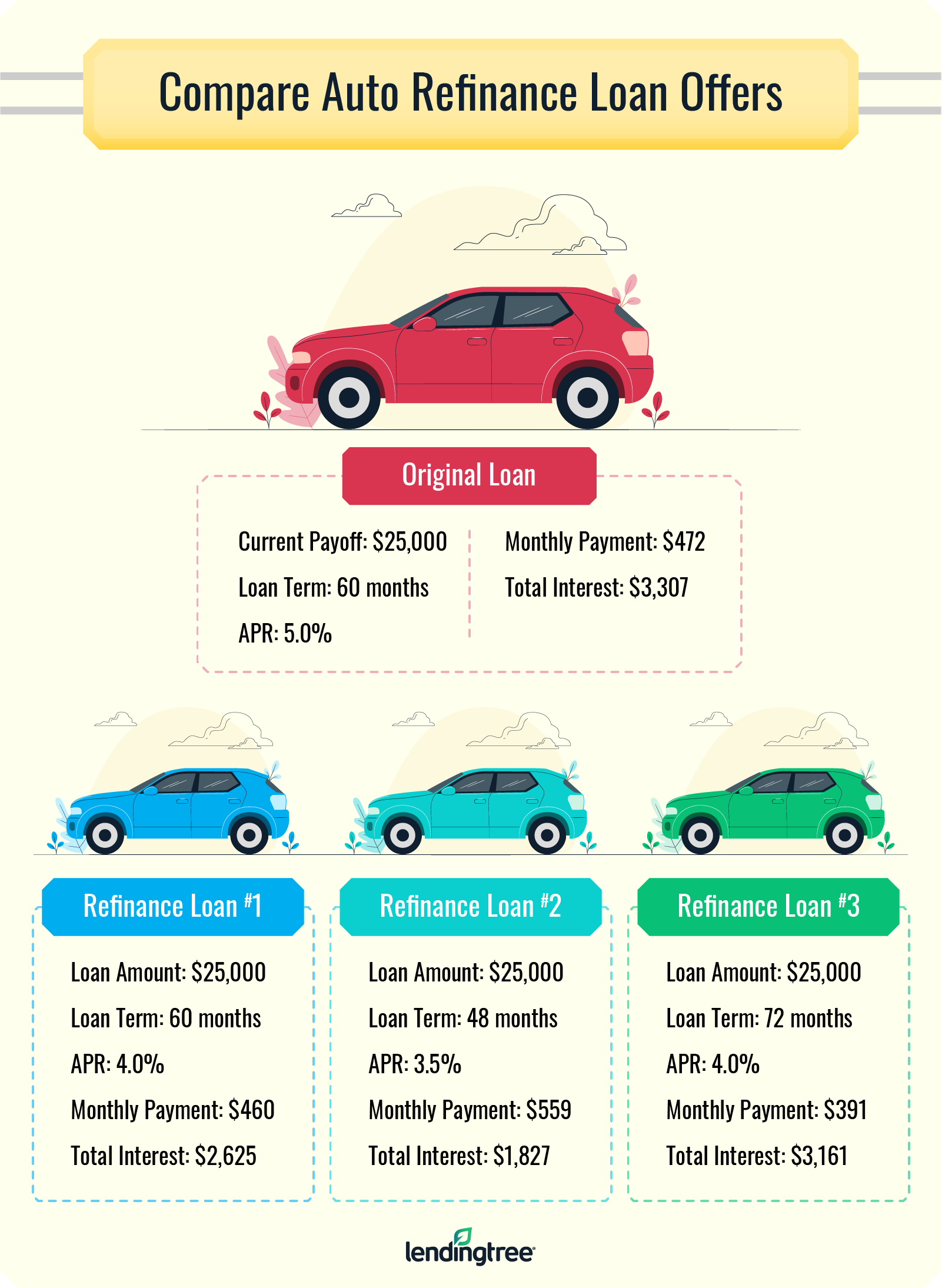

Refinancing a new car means that you take out a new loan to pay off the old one. Perhaps the most confusing part of buying a car on someone elses behalf is the car loan process. The person receiving the car will need to go to the dealership in person to cosign the loan and if youre.

Name as shown on a valid identification card first middle and last name Date of birth. The exact process whereby someone endorses a check so that you can deposit it into your own account may vary from bank to bank or credit union to credit union. The other person whose name is remaining on the title will be listed as the buyer.

The amount of this fee varies. A joint auto loan is when a primary borrower shares a car loan with either a cosigner or a co-borrower. The most basic way to move money into someone elses account is to walk into the bank and tell the teller youd like to deposit cash.

There are times when a car lease might no longer work for your situation. The cost to transfer or sign over your car title to someone else can depend on where you live and the type of vehicle being transferred. Someone with poor or bad credit can qualify for a cash-out refinance.

In order to buy a vehicle for another party youll have to put the loan entirely in your name cosign or co-borrow with the recipient. To make you an authorized user the primary account holder simply adds your name to their credit card account giving you authorization to use it. You may be considering terminating your car lease early but doing so can come at a high price.

If you are ready to buy a car within the next 30 days search for vehicles using the form at the top of Chase Autos car buying site. Understanding refinancing your car. You may have needed a cosigner or co-borrower to get approved but things change and you may no longer need or want their name on the loan.

Treat the name change as a sale. Another option is to have the other borrower refinance the loan into their name. Refinance or consolidate.

By cosigning they agree to pay back the loan if you default or else take a big hit to their credit score. If you want to remove someones name from a joint auto loan you need to refinance the loan on your. Without a license you may still be able to purchase a car.

After someone passes away their car insurance policy will need to be canceled but it does not happen automatically. The person whose name is being removed from the title should complete the sections on the back of the title certificate as though he or she were selling the car. To qualify for a refinance the borrower needs to have a good credit history and enough income to make the new loans monthly payments.

In general this involves the person writing your name on the back and signing the check. Being an authorized user means you can use someone elses credit card in your name. If youre saddled with bad credit you may have been the one asking for a co-signer.

Having Someone Endorse a Check So You Can Deposit It In Your Account. Youll need the recipients full name and bank account number. Trip contact information name email address and phone.

Used cars are less expensive than new ones and you may be able to buy one for the same amount. You can make purchases and use the card as if it were your own but youre not the primary account holder.

How Soon After Purchase Can You Refinance A Car Lendingtree

Can I Get My Name Off A Car Loan Rategenius

Can I Get My Name Off A Car Loan Rategenius

How To Refinance A Car Loan In 5 Steps Lendingtree

Can I Refinance My Car Loan To Someone Else Auto Credit Express

Is It Possible To Do An Auto Refinance In Someone Else S Name

0 comments

Post a Comment